Annual Report 2024-25

Acknowledgement of Country

HomeStart respectfully acknowledges the Traditional Owners of the lands across South Australia, and we pay our respects to Elders, past, present, and emerging.

As an organisation dedicated to creating home ownership for South Australians, we recognise and respect the First Nations people as the traditional custodians of the land and we honour their cultural heritage, beliefs, and the enduring spiritual relationship that exists between Aboriginal people and Country.

Our offices are located on the lands of the Kaurna peoples.

Letter of transmittal

22 September 2025

The Hon. Tom Koutsantonis MP

Treasurer of South Australia

Parliament House

North Terrace

Adelaide SA 5000

Dear Treasurer,

HomeStart’s 2024–25 Annual Report

I am pleased to present a summary of HomeStart’s achievements over the 2024-25 financial year.

HomeStart provided a record $1.4 billion in new loans to 2,923 home buyers, bringing the total number of South Australians helped by HomeStart to more than 91,000.

This is my final report as Chair of the HomeStart Board. It has been a privilege to support HomeStart in its purpose to help more people into home ownership in more ways.

Should you have any questions about the report, I would be pleased to provide you with further information.

Yours sincerely,

Jim Kouts | Chair

Message from the Chair

Jim Kouts

Strong institutions play a critical role in the economic development of the state and HomeStart continues to have a formidable capacity to deliver both for its customers and the South Australian community. As I step down as Chair, my final report gives me pause to reflect on the long-term achievements of this most beloved and respected South Australian institution.

Emerging from the global financial crisis in 2010, the value of HomeStart’s new lending was $472 million. The business rebounded through the next decade and faced the challenge of COVID head on. With low interest rates not seen since the 1960s, one could ask why we needed an institution such as HomeStart when mainstream finance was readily available.

Yet, as housing affordability has since worsened, HomeStart has played a significant role in helping South Australians buy a home when they couldn’t access mainstream finance - and this past financial year has been no different.

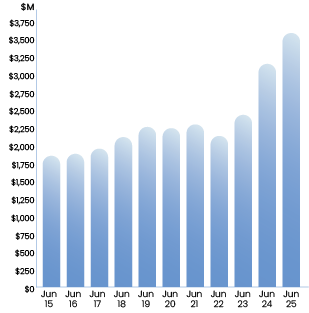

Amid one of the most challenging housing markets, this year we provided $1.4 billion in new loans. Of utmost importance, 2,923 loans were delivered seamlessly. HomeStart’s pre-tax underlying profit of $48.1 million and headline profit of $65.1 million were both higher than the prior year. Since 2010, our portfolio value has risen from $1.7 billion to $3.6 billion.

In 2010, we returned $20.8 million to the State Government and in 2024-25 we contributed $100.6 million. This brings our total contribution since HomeStart’s inception to more than $1.1 billion, which is vital for the state economy.

Most importantly, throughout its 35-year history, HomeStart has helped more than 91,000 South Australians into home ownership. We have stood true to our values, remained committed to our purpose, and made the dream of home ownership a reality for more people in more ways.

Today, we are in the midst of a complex housing market where the interest rate cycle has reversed, cost-of-living pressures continue, housing supply remains a challenge and house prices continue to rise.

The scale and complexity of HomeStart’s role has grown significantly and our financials paint a picture of sound long-term decisions.

HomeStart proudly delivers on its purpose within a commercial framework. While our offering to customers is unique and flexible, we uphold responsible lending practices. Good corporate governance is critical to this balance. HomeStart’s governance model continues to underpin its organisational success.

Our results demonstrate the increasing community need for HomeStart’s support. Significant economic challenges remain ahead. As South Australia responds to the national housing crisis through the State Government’s Housing Roadmap, it will be critical that the independence of HomeStart’s framework allows it to continue to deliver on its remit.

Among the ingredients of a strong organisation is a sustainable policy on dividends and capital and the maintenance of a skilled Board.

As I conclude my term as Chair, HomeStart has farewelled two highly-capable business people in long-serving Deputy Chair Chris Ward and Board Member Sue Edwards. I offer my personal thanks – and that of the entire Board – for their outstanding contributions to HomeStart.

I have served 12 years as Chair of HomeStart’s Board after an apprenticeship as Deputy Chair. As my stewardship of HomeStart comes to completion, I thank the various Ministers and Treasurers and their teams who have supported the business.

HomeStart is all about people – the people of South Australia, our diverse customers, and our passionate HomeStart team. I would particularly like to acknowledge the considered leadership of CEO Andrew Mills and his executive team, his predecessors, and the entire HomeStart workforce, who have been relentlessly committed to breaking down barriers to home ownership for South Australians.

Owning a home is important to financial security and it has been an absolute privilege to help tens of thousands of South Australians to achieve their home ownership dream.

Jim Kouts | Chair

Message from the CEO

Andrew Mills

The dream of buying a home remains a challenge, and HomeStart’s results tell a compelling story of delivering for the community in a time of genuine need. Economic forces in the past year included cost-of-living pressures, South Australian house prices reaching unprecedented levels, and a turning point in the interest rate cycle. Through these conditions, HomeStart’s strengths facilitated another year of record lending.

In the 2024-25 financial year, HomeStart proudly helped 2,923 home buyers – including 1,803 first home buyers - into home ownership. A significant portion of lending supported new housing supply, with 1,424 construction-related loans. Our overall lending value was a record $1.4 billion.

Our results continue to prove shared equity’s important role as a means of helping people into home ownership. We provided a record 1,170 additional loans through our Shared Equity Option, a 32% increase on the previous year. More than 40% of new customers benefited from shared equity.

Importantly, 173 customers paid out the shared equity portion of their loan, most commonly by refinancing to another lender. HomeStart’s model recognises that once customers have built equity, refinancing can be a positive next step, and several initiatives were introduced this year to better inform customers about refinancing pathways.

Total discharges reached a record $826 million, up 93%, with 88% of this total due to refinancing. Many customers expressed pride in “paying it forward”, knowing their repayments would help other South Australians into home ownership.

Portfolio credit quality remained strong through the year and our 90-day arrears rate remained low at 0.33%.

At an operational level, we launched a new loan origination system, and I wish to thank all involved in this long and complex project.

Significant improvements in service to borrowers and brokers has been achieved as a result, with substantial improvement in our ‘time to yes’ measure, as well as introducing digital loan application capability. Many home buyers prefer to use mortgage brokers, who play an important role in helping us reach more South Australians. In the past financial year, 79% of new lending occurred via brokers, an increase of 9%.

This year’s results are a reflection of our employees, and I thank the entire HomeStart team for their hard work, commitment to our purpose, and care for our customers and each other. We have built an environment where people feel they can speak up, illustrated by the 91% participation rate in our engagement survey, and a further lift in our engagement scores.

As we look towards another challenging year, I thank the Treasurer and his team for their continued support of HomeStart. I also thank my Executive team for their leadership and support, and join our Chair in thanking outgoing Deputy Chair Chris Ward and Board Member Sue Edwards for their valued contribution to the HomeStart Board. Lastly, I would like to acknowledge and thank Chair Jim Kouts for his outstanding service to the Board, and particularly as Chair since 2013.

Each day we are privileged to be a part of another South Australian home buyer’s story. Behind every loan are the hopes and dreams of people who want to own a home. We are fortunate to be a part of their journey. All who work within and in partnership with HomeStart should be proud of the difference we make for so many South Australians. More than 91,000 South Australians have now had a home to call their own, thanks to HomeStart. We look forward to helping many more in the coming years.

Andrew Mills | Chief Executive Officer

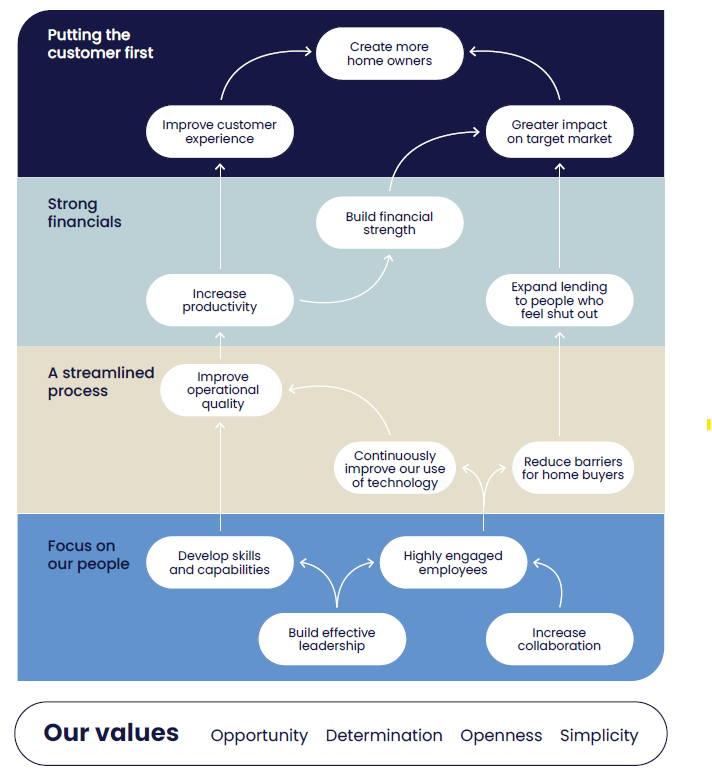

Strategic Plan 2024-27

The HomeStart Strategic Plan for 2024-27 reinforces the strong sense of determination that exists within HomeStart to open doors for those who feel shut out.

Through this plan, we aim to help create thousands of new home owners, enabling more South Australians to achieve their goals and aspirations.

A year into the plan, we are making significant progress, including delivering record lending in 2024-25.

The strategy map illustrates our strategic priorities, with our people as the foundation of everything we do.

2024-25 highlights

As HomeStart concluded the first financial year of our three-year strategic plan, we remained centred on making home ownership a reality for more people in more ways.

Strong outcomes were realised across all four key areas of strategic perspectives during the year – Customer, Financial, Process and People.

Customer

| 2,923 New loans |

| 1,803 First home buyers |

| 49% New loans were construction-related |

| $494,335 Average loan value |

Financial

| $48.1M Underlying profit |

| $3.6BN Portfolio |

| $1.4BN Total lending |

| $100.6M Contributed to State Government |

Process

| 2,858 Loans discharged |

| $826M Loans repaid by customers discharging |

| 79% Loans via Brokers |

| 0.33% 90-day arrears rate |

People

| 91% Participation in employee engagement survey |

| 0 Lost time injury days |

| 55% Female employees |

| 100% Employees had a performance development discussion recently |

HomeStart’s role

Helping deliver on housing affordability

A statutory corporation under the Urban Renewal (HomeStart Finance) Regulations 2020, HomeStart reports to the South Australian Treasurer, the Hon. Tom Koutsantonis MP.

HomeStart is empowered to:

- Facilitate home ownership in South Australia by lending and providing other forms of financial assistance, including finance on concessional or special terms for low to moderate income earners.

- Provide, market, and manage home finance products and facilitate alternative schemes to encourage home ownership, including mortgage relief schemes and facilitate finance to develop community housing and aged care residential facilities.

We are helping more South Australians into their own home sooner and boosting their borrowing power through our innovative loans.

This year, we have helped 2,923 home buyers, including 1,803 first home buyers.

Supporting housing supply

HomeStart is also supporting housing supply through construction-related lending.

In 2024–25, we provided a record 1,424 construction-related loans allowing customers to build or buy a newly built home.

This not only increased housing supply, but also helped ease pressure on the rental market by supporting renters to buy their own home.

In 2024–25, about 600 customers moved from private rental into newly built homes, freeing up approximately 50 rental properties each month.

Refinancing is part of the journey

We celebrate every step our customers take on their home ownership journey, including when they refinance or move on. This shows we have helped them achieve home ownership and supported them to take the next step as their circumstances change.

In 2024–25, an increasing number of HomeStart customers were able to refinance after building equity in their home and growing their financial confidence.

Over the year, 2,858 loans were discharged, returning $826 million that can now provide opportunities for new HomeStart customers, with refinancing accounting for 88% of these discharges.

-

"HomeStart provides an essential opportunity for home ownership in SA. With housing costs increasing so significantly compared to income, having this option to obtain a mortgage with an achievable deposit…makes such a difference."

— HomeStart Customer

HomeStart’s customers

Opening doors

Prospective home buyers and renters across the state are finding it increasingly difficult to secure affordable housing with the cost-of-living pressures. At HomeStart, we continue to evolve our low deposit home loans to help open doors for South Australians who feel shut out of the housing market, supporting more people into home ownership at different stages of life and in a variety of situations.

In 2024-25:

- 62% of our customers were first home buyers

- 72% of all construction-related loans were taken out by first home buyers

- 64% of our customers were aged between 18 and 39

- 51% were single

- 12% were single parents

- 54% moved from private rental

- The median gross household income was $99,878

- The average price of a metro property purchased through HomeStart was $606,824

- The average price of a regional property purchased through HomeStart was$487,365

- 41% of properties were purchased in northern Adelaide

- 19% in southern Adelaide

- 27%in regional areas

-

“HomeStart do all they can to help customers with every stage of their lives...Great place where the customer is in front focus.”

— HomeStart Customer

HomeStart’s loans

Home loans

With rising house prices continuing to make it difficult to save for a deposit, HomeStart settled 2,923 loans, helping more South Australians into home ownership. The Graduate Loan and HomeStart Loan were key contributors to this total.

Graduate Loan The Graduate Loan is available to customers with a Certificate III or higher and can be used to buy or build a home, with deposits starting from 2% | FY 2024-25 | SINCE INCEPTION | |

1,111Graduate Loans | $647M+Graduate Loans value | 10,164Total Graduate Loans | |

HomeStart Loan The HomeStart Loan allows customers to buy or build a home, with deposits starting from 5%. | FY 2024-25 | SINCE INCEPTION | |

1,657HomeStart Loans | $719M+HomeStart Loans value | 30,824Total HomeStart Loans | |

Total loans (2,923) include 1,657 HomeStart Loans, 1,111 Graduate Loans and 155 other loan types.

Helping people buy and build new homes

Of the Graduate Loans and HomeStart Loans settled during the year, many were taken up by customers choosing to build or buy newly constructed homes. These loans were supported by construction loan features and builder partner incentives. State government grants and stamp duty concessions were also available to eligible first home buyers.

Construction-related lending Our construction loans are designed to make building a home possible with flexible repayment options. | FY 2024-25 | SINCE INCEPTION | |

1,424Loans for construction related purposes | $625MConstruction related loans value | 9,766Total construction related loans | |

Repayment Safeguard

A unique benefit of all HomeStart loans is the Repayment Safeguard. It sets our customers’ repayments at an affordable level from the start of the loan.

The repayments are then only adjusted once every 12 months in line with inflation, not when interest rates change. The certainty of our Repayment Safeguard makes it easier for customers to budget and manage finances once a home is purchased.

HomeStart offers a range of additional loans that can be taken out at the same time as a home loan to increase buying power and manage upfront costs without increasing repayments. These options make home ownership more achievable for South Australians.

Additional loans to boost buying power

Shared Equity Option HomeStart’s Shared Equity Option allows customers to borrow up to 25% of the purchase price as an interest-free and repayment-free loan, whether buying or building a home. In return, HomeStart takes a share of any capital gain or loss when the property is sold. | FY 2024-25 | SINCE INCEPTION | |

1,170Shared Equity Option Loans | $157M+Shared Equity Loans value | 4,114Total shared equity loans | |

Advantage Loan The Advantage Loan increases low-to-moderate income earners’ buying power without increasing monthly repayments. | FY 2024-25 | SINCE INCEPTION | |

79Advantage Loans | $2.5MAdvantage Loans value | 14,689Total Advantage Loans | |

Additional loan for upfront costs

Starter Loan The Starter Loan helps customers cover upfront costs such as stamp duty, establishment fees, or other related expenses. It provides up to $10,000 with no interest charged or repayments required for the first 7 years. | FY 2024-25 | SINCE INCEPTION | |

385Starter Loans | $3.2MStarter Loans value | 2,142Total Starter Loans | |

Home equity options for seniors

Seniors Equity Allows customers aged 60 and above to access part of their home’s equity with a ‘no negative equity’ guarantee through our reverse mortgage. | FY 2024-25 | SINCE INCEPTION | |

146Seniors Equity Loans | $20MSeniors Equity Loans value | 3,361Total Seniors Equity Loans | |

-

“HomeStart provides loan options towards home ownership that suit different financial needs and obligations. Very favourable and accommodating.”

— HomeStart Customer

Customer and community impact

Customer experience

77% Customer Experience Score for FY 2024-25

37% Improvement in Time to Yes (YoY)

74% Broker Satisfaction Score for FY 2024-25

36 Net Promoter Score for FY 2024-25

Community engagement

Seminars

HomeStart provides free educational seminars to help participants gain the knowledge, tools, and confidence to begin their journey toward buying or building a home.

7 Home Buyer Seminars

393 Attendees

Home Buyer Ready program

Home Buyer Ready provides information to help customers get started to buy or build their own home, such as how to budget and save for a deposit, understand the costs involved, how to work out how much they can borrow and what their repayments might be.

2,812 Users

679 Modules completed

Community partnerships

|  |  | |

Member and Community Partner | Fashion and Costume Parade Naming Rights Partner | Naming Rights Partner for Family Zone and Presenting Partner for Free CBD Shuttle | Scholarship Sponsor |

Donations

HomeStart proudly partnered with Habitat for Humanity SA, volunteering our time and contributing $6,016 to help create safer spaces for those in need. In total, we donated $7,266 during FY 2024–25, demonstrating our commitment to building stronger communities.

Learning and growth

Continuous professional development

At HomeStart, we believe our people are our greatest asset. That’s why we invest in continuous learning and development to help our team grow, thrive, and deliver the best outcomes for our customers.

Through our employee surveys, we know that employees value HomeStart’s collaborative culture, health and wellbeing program, high levels of engagement, and commitment and passion to help customers.

In 2024-25 we supported continuous professional development through a variety of programs, resources and systems.

Our workforce

- HomeStart’s workforce is 55% female and 45% male.

- The executive team consists of 40% female and 60% male leaders.

- 9% of employees are employed part-time.

- 37% of employees were born overseas.

Professional development achievements

- 4,000+ hours dedicated to training.

- 29% of staff are trained or accredited in Mental Health First Aid (MHFA).

- 100% of leaders completed Psychosocial Hazards training.

Change management program

The Executive Team and senior leaders participated in Reframe Change, a development program to shift how we see change. The program marked a new approach to change management, maturing how we identify and manage change in the business. With this strong foundation, Reframe Change will be embedded into team operations through a Change Management Framework in 2026.

Learning and performance management systems

The rollout of new learning management and performance management systems brought significant improvements to how we oversee and deliver learning and manage performance across the organisation. Customisable reporting tools offer timely and targeted insights, with automated notifications delivered directly to leaders for action. Regular compliance training is being delivered through the platform and includes monthly cybersecurity training, which ensures ongoing awareness of cyber risks.

We continued to leverage the newly implemented Performance Management System and Learning Management System with all employees now engaging in systematic and regular check-ins to discuss performance, behavioural and developmental objectives and opportunities.

New employee engagement system

HomeStart transitioned measurement of employee engagement to Gallup, which allowed leaders to manage participation from their desktops. There were two surveys during the year. The participation rate for the latest survey was 91%, which was well above our target of 80%. There has been an overall increase in the Engagement Index of more than 9%.

To further support engagement, in addition to our 30 day onboarding survey, we have implemented 60 and 90 day onboarding surveys. This is an opportunity for employees to reflect on their first three months and share impressions from a new starter to an integrated team member. Insights from the survey will help to inform ongoing improvements to our onboarding program.

Training and development expenditure

HomeStart invested $432,119 in training and developing its people over the course of the year equating to 2.29% of salary expenditure.

Performance

As of June 30, 2025, 100% of employees had a performance development discussion in the preceding six months.

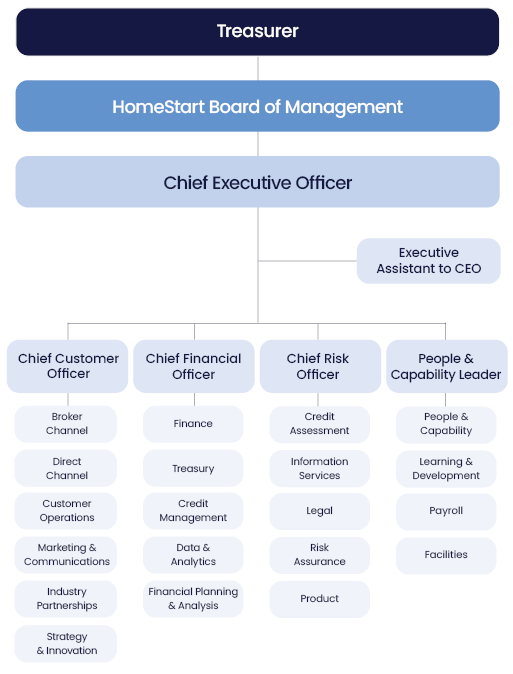

Organisation chart

Our Board

| Jim Kouts | ChairJim Kouts has significant commercial, strategic and governance experience across a range of national and state based private and government sector organisations. He is a former senior national executive having worked for two global energy groups for close to 20 years. Jim is Deputy Chair and Non-Executive Director of the Adelaide Economic Development Agency, and a Non-Executive Director of Business Events Adelaide (BEA). Until recently he was Chair of BEA. He is also a Non-Executive Director of the Adelaide Venue Management Corporation and a long-term strategic adviser to both Adelaide Airport Limited and Flinders Port Holdings. Jim was appointed Chair of HomeStart in December 2013, having previously been Deputy Chair. |

| Chris Ward | Deputy ChairChris Ward is a professional Non-Executive Director, having had more than 30 years of broad executive experience, primarily in banking and finance. He is an Advisory Board Chair to two private companies. Chris is a former Non-Executive Director, Chair of the Risk and Audit Committee, and member of the Remuneration Committee at the South Australian Film Corporation, a former Non-Executive Director of the Australian Dance Theatre and was an Executive Partner at UniSA. Chris was appointed to the HomeStart Board in June 2012, appointed Deputy Chair in December 2013 and was Chair of the Asset and Liability Committee (ALCO). Chris completed his term on the Board in June 2025. |

.jpg) | Andrew Seaton | Board MemberAndrew Seaton is Managing Director and Chief Executive of Australian Naval Infrastructure. He has extensive finance, strategy, commercial and project management experience, having worked in banking, natural resources and defence industries for more than 35 years. Andrew previously held the roles of Chief Financial Officer at Santos Limited, Vice-President Investment Banking with Merrill Lynch and Client Director with NAB. He is a Non-Executive Director of ASX-listed Strike Energy Ltd. Andrew was appointed to the HomeStart Board in 2019 and is the Chair of the Audit and Risk Committee. |

| Shanti Berggren | Board MemberShanti Berggren is the General Counsel and Executive Director of Legal Services at the University of Adelaide. She is a commercial lawyer who has worked in private practice and in-house roles in Los Angeles, Singapore, and Sydney. She is also a Director of the Adelaide Football Club. Shanti was appointed to the HomeStart Board in March 2017. |

| Sue Edwards | Board MemberSue Edwards is a chartered accountant and is currently a Director of Mitolo Family Farms and Executive Officer of the Mitolo Family Office. She is a former Partner at Deloitte where she specialised in providing business advice, including strategy, finance and taxation, and is a former treasury manager. Sue Edwards was appointed to the HomeStart Board in December 2010. Sue completed her term on the Board in December 2024. |

| Stella Thredgold | Board MemberStella Thredgold brings extensive experience from her career as an experienced ASX 100 C-Suite executive with national responsibilities specialising in the banking, superannuation and finance industry. She consults and advises on leading organisations through change with experience in delivering complex transformations relating to strategy, risk and compliance, customer experience, technology, people, organisational culture, digital transformations and corporate governance. Stella is also a Non-Executive Director of Discovery Parks, and Slater & Gordon. Stella was appointed to the HomeStart Board in February 2024. |

.jpg) | Richard Bryant | Board MemberRichard Bryant brings with him more than 40 years of leadership experience in the property, construction, and engineering sectors, holding high-level strategic and general management roles. His career has seen him establish and oversee businesses throughout Australia, where he has applied his considerable expertise in formulating and implementing business strategies, organisational structures, staffing, and operational systems. Additionally, Richard has contributed his leadership to various board roles within both the commercial and not-for-profit sectors. Richard was appointed to the HomeStart Board in May 2024. |

Board attendance data

Board attendance

Eligible to attend | Meetings attended | |

| Jim Kouts | 11 | 11 |

| Chris Ward | 11 | 11 |

| Andrew Seaton | 11 | 11 |

| Shanti Berggren | 11 | 11 |

| Sue Edwards | 6 | 6 |

| Stella Thredgold | 11 | 10 |

| Richard Bryant | 11 | 10 |

Asset and Liability Committee attendance

Eligible to attend | Meetings attended | |

| Chris Ward | 11 | 11 |

| Shanti Berggren | 11 | 11 |

| Sue Edwards | 6 | 6 |

| Stella Thredgold (Alternate) | 5 | 5 |

Audit and Risk Committee attendance

Eligible to attend | Meetings attended | |

| Andrew Seaton | 7 | 7 |

| Stella Thredgold | 7 | 6 |

| Richard Bryant | 7 | 7 |

Our Executive team

| Andrew Mills | Chief Executive OfficerAndrew Mills became Chief Executive Officer in January 2022, having previously held senior executive positions across the organisation over the past decade. He possesses strong financial and business acumen and has been a key contributor to the success of HomeStart, fostering strong relationships within the organisation and externally. Andrew brings a unique focus on product innovation, digital transformation and organisational development, which is instrumental in leading HomeStart through this challenging time in the housing market. His commitment to help more South Australians into home ownership is coupled with a belief that HomeStart can continue to play a key role in the economic and social prosperity of the State. |

| Vas Iannella | Chief Customer OfficerVas Iannella joined HomeStart in May 2020 as Chief Customer Officer, bringing more than 15 years of experience in retail and commercial banking. Throughout her career, Vas has been instrumental in transforming customer experiences and aligning people, processes and technology to deliver exceptional outcomes. At HomeStart, she leads the organisation’s customer-focussed functions, including marketing and communication, customer support, and strategic partnerships. Vas also plays a key role in shaping HomeStart’s organisational strategy and driving innovation to ensure the business continues to meet the evolving needs of South Australians. |

| Simon Olifent | Chief Financial OfficerSimon Olifent joined HomeStart as Chief Financial Officer in January 2024. He was previously at Westpac in Sydney where he worked in senior finance roles for more than 13 years, including Finance Director for the past four years. Prior to his banking experience, he was a Senior Manager of Audit and Transaction Services at global professional services firm PwC, based in Sydney and Adelaide. |

| Ryan Officer | Chief Risk OfficerRyan Officer joined HomeStart as Chief Risk Officer in October 2021. He has held roles across multiple facets of the banking sector with experience in business and retail banking in both sales and risk management. In this role, Ryan has oversight of credit and operational risk and compliance, legal, information services and products. |

| Vanessa Charlesworth | People and Capability LeaderVanessa Charlesworth joined HomeStart in 2010. She has worked as an HR professional for more than 25 years in the health and finance industries. At HomeStart, she uses her professional skills and knowledge to assist and guide the organisation strategically on a broad range of matters across a range of disciplines including employee relations, talent management, work health and safety, learning and development, recruitment and remuneration. |

Corporate governance

HomeStart Finance is a statutory corporation operating under the Urban Renewal (HomeStart Finance) Regulations 2020. HomeStart falls under the Ministerial responsibility of the Treasurer, the Hon. Tom Koutsantonis MP in the South Australian Government. HomeStart’s approach to corporate governance is guided by legislation, State Government guidelines issued by the Department of Premier and Cabinet, Treasurer’s Instructions issued by the Department of Treasury and Finance, ASIC, and principles of best practice.

Board of management

HomeStart is administered by a seven-member Board of Management (the Board). Board members are appointed by the Governor, on the advice of the Chief Executive of the Department of Premier and Cabinet, for a term not exceeding three years, and are entitled to such remuneration, allowances and expenses as determined by the Governor. The members who held office during 2024-25 are identified on pages 16 to 17. Board member remuneration information is provided in Note 8 of the financial statements.

Board members are independent of the organisation and chosen for their expertise and skills in matters related, or complementary to, HomeStart’s business. The Board is responsible to the Treasurer for overseeing HomeStart’s business operations, with a focus on corporate accountability, strategic planning, monitoring, policy development and protecting the State Government’s financial and other interests in the organisation.

A Department of Treasury and Finance appointed observer is invited to each Board meeting. The following committees of the Board operate under individual charters and assist the Board in discharging particular functions. Committee members are selected for their expertise and independence.

Audit and Risk Committee

This committee is chaired by Andrew Seaton and membership includes two other Board members. Management personnel and representatives of the Auditor-General and internal auditors also attend meetings.

The Audit and Risk Committee’s primary responsibilities are:

- Monitoring risk management processes and status of risks and internal controls.

- Reviewing the financial reporting process and outputs.

- Reviewing compliance with relevant laws and regulations.

- Monitoring the internal and external audit functions.

- Monitoring internal control processes.

- Approving changes to the risk management framework.

- To operate in a commercial manner and manage risk prudently.

Asset and Liability Committee (ALCO)

This committee was chaired by Chris Ward until 27 June 2025 followed by Stella Thredgold for the remainder of the financial year. The committee includes two other Board members plus the Chief Executive Officer (CEO) and Chief Financial Officer (CFO). Other management personnel and representatives from the South Australian Government Financing Authority (SAFA) also attend.

The HomeStart Board has established ALCO to:

- Ensure HomeStart’s asset and liability risks are managed in a prudent manner; and

- Maintain sound, prudent financial asset and liability management frameworks and controls that result in the long-term financial viability of HomeStart.

Business planning, monitoring and accountability

The Board, in conjunction with Management, establishes and reviews strategic directions and objectives for the business on an annual basis, considering external environmental factors, commercial best practice and internal goals.

These activities enable HomeStart to fulfil its purpose and deliver its long-term goals in alignment with government objectives, targets and policy directions.

The Board uses a balanced scorecard quarterly to measure progress against strategic objectives. The individual subcommittees of the Board provide feedback on activities undertaken in discharging the duties under their respective charters.

HomeStart incorporates appropriate risk management standards and practices into all significant new business activities or initiatives, in line with the South Australian Government’s Risk Management Policy Statement.

The Board assesses the performance of the CEO on a regular basis against current strategic and business objectives.

Board member benefits

During or since the 2024-25 financial year, no Board member has received or become entitled to receive a personal benefit (other than a remuneration benefit included in Note 8 to the financial statements) because of a contract made with HomeStart by:

- The Board member.

- Any organisation of which the Board member is a member.

- Any entity in which the Board member has a substantial financial interest.

- An associate of the Board member.

Executive appointment and remuneration

Responsibility for the appointment of the CEO rests with the Board. Responsibility for executive appointments rests with the CEO. Details of executive remuneration are set out in Note 7 to the financial statements.

Risk management

HomeStart has an enterprise-wide approach to managing risks to ensure they are identified and managed at all levels of our operations.

While oversight of risk management remains the primary responsibility of the Board, each committee has specific roles and responsibilities in relation to risk management. The Audit and Risk Committee monitors all operational risks, including a regular review of the areas of highest risk. The Asset and Liability Committee (ALCO) monitors all credit and market risks.

Risk management is an integral part of everyday work and is supported by:

- An Assurance Framework that outlines how risk is managed at HomeStart.

- A Risk & Compliance Management Policy that provides the roles and responsibilities for each of the three lines; employees, Risk Assurance, and independent assurance such as Internal Audit.

- A Risk Appetite Statement summarising HomeStart’s tolerance against various risk indicators.

- Identification, assessment (using AS/NZS ISO 31000:2018) and recording of risks and controls through a risk management system.

- Continuous monitoring and reassessment of risks and internal controls, prompted by our risk management system’s interactive email capability and through regular discussion at executive and team level.

- Organisation-wide feedback on existing and emerging risks.

- Comprehensive reporting to Executive Committee, Audit and Risk Committee and Board.

Strategic risk

Discussion and assessment of risks and opportunities form part of our strategic and business planning process to enable us to prioritise objectives, maximise outcomes and mitigate threats. Our planning considers our external environment, market context, ministerial and government objectives as well as internal capabilities.

Risk and control self-assessments are conducted for each division against the strategy to ensure current risks are captured and monitored or mitigated.

Credit risk

Credit risk is inherent in HomeStart’s core function of lending. Lending policies are founded on sound credit risk management and behavioural intelligence, which is incorporated into each stage of a customer’s loan application and ongoing loan management.

Analysis is underpinned by credit risk systems that have been developed using a combination of theory and experience, drawn from the behaviour of our customer base.

Regular and comprehensive reporting and monitoring is provided to ALCO, Audit and Risk Committee and Board.

Market risk

A comprehensive set of policies govern HomeStart’s funding and interest rate risk management activities. These policies are monitored by ALCO at its monthly meetings and regularly by the Chief Financial Officer. HomeStart’s funding is entirely sourced from the South Australian Government via the South Australian Government Financing Authority (SAFA), so the exposure to market risk is limited to SAFA’s exposure.

Operational risk

Operational risks are those inherent in the day-to-day functions of HomeStart. The risk management system facilitates a comprehensive assessment, communication and monitoring framework for these risks. Management regularly reviews its risk profiles to ensure appropriate internal controls are in place and operating effectively. Any incidents that occur are recorded against the relevant risk and are investigated and mitigated where possible, within set timeframes dependent on the risk rating.

Information security risk management

HomeStart has a Cyber Security Program to safeguard against information security risks as outlined in the standard ISO/IEC 27001:2013 Information Security Management. The program includes a suite of policies specific to information security.

Compliance, internal control and assurance

HomeStart’s organisational compliance framework supports the identification and assessment of our legal obligations and management and monitoring of our compliance responsibilities on an ongoing basis. This framework is reviewed on a regular basis to reflect any relevant legislative changes or any organisational structure and subsequent role changes.

HomeStart’s Board is responsible for ensuring robust and effective internal controls exist to minimise the risks inherent in our business. Internal controls are regularly reviewed in line with the Assurance Framework and Control Testing Methodology to ensure their effectiveness and to identify any assurance gaps and areas of improvement.

An Anti-Money Laundering and Counter Terrorism Financing Program is in place with suspicious matters reported to the Australian Transaction Reports and Analysis Centre (AUSTRAC).

While internal fraud is a risk that HomeStart is exposed to in various areas of the business, no inappropriate activity has been identified.

Strategies to prevent fraud are in place at all levels of our operations including:

- A register of delegations.

- An internal audit program.

- Segregation of duties.

- Dual controls in appropriate areas.

- Internal policies, procedures, monitoring, and reconciliation.

- Regular and ongoing compliance training for all employees.

- A Fraud and Corruption Control Plan.

- Public Interest Disclosure process.

- A strong internal culture and organisational values.

Internal and external audit

External audit is undertaken by the Audit Office of South Australia and an Independent Auditors Report is provided to the Board. The report for this financial year can be found on page 61.

Deloitte conducted the operational internal audit function for 2024-25 which was based on a three-year rolling audit plan.

Statutory information

Freedom of Information Act 1991 – Information Statement

HomeStart Finance is a statutory corporation, established under the Urban Renewal Act 1995 and is governed by the Urban Renewal (HomeStart Finance) Regulations 2020, to facilitate home ownership opportunities for South Australians, with a particular focus on low-to moderate income households. HomeStart operates in a commercial manner to achieve financial and other performance benchmarks that are established and agreed with the State Government.

Policy documents

The following policy documents are held by HomeStart and are available on request, free of charge:

- HomeStart home loan brochures.

- HomeStart guide to fees and charges.

- HomeStart Privacy Policy.

- HomeStart Credit Reporting Policy.

- HomeStart Annual Report.

- HomeStart Target Market Determinations.

Copies of these documents can be accessed from homestart.com.au or by contacting the Freedom of Information Officer on (08) 8203 4750.

Access to personal information

Customers are entitled to obtain access to their personal information held by HomeStart in accordance with the Freedom of Information Act 1991. HomeStart may deny a request for access if required, obliged or authorised to do so under any applicable law, including the Freedom of Information Act 1991. Any request for access to personal information must be in writing and must be sent to the Freedom of Information Officer.

HomeStart will respond to all requests for information under the Freedom of Information Act 1991 within 30 days of receipt of the request. Fees and charges may be payable.

Public Interest Disclosure Act 2018

No public interest information has been disclosed to a responsible officer of HomeStart under the Public Interest Disclosure Act 2018 (SA).

Proactive disclosures

HomeStart provides proactive disclosures of information on its website.

Work Health & Safety (WHS)

HomeStart is dedicated to maintaining a safe, injury-free workplace and fostering high employee engagement. We consistently meet key Work Health and Safety (WHS) legislation requirements and keep our WHS Manual up-to-date with legislative changes and regular reviews. Our robust Safety Management System systematically manages safety risks, enhances safety practices, demonstrates corporate due diligence, and strengthens our overall safety culture.

Activities that support a safe work environment include:

- Regular training sessions on emergency procedures.

- Ongoing education for new employees.

- Onsite refresher and/or training of Mental Health First Aid Officers.

- First Aid Officers training.

- Emergency evacuation drills.

- Annual influenza vaccination program.

- Skin check program.

- Provision of online training; mandatory and optional opportunities.

- Choice of Employee Assistance Program providers.

- Undertaking risk assessment and hazard identification by way of worksite inspections across all locations.

- Ergonomic assessments in the workplace and work from home environments.

- The Healthy Body and Mind hub with monthly newsletters, webinars, live classes, resources, etc.

- Healthy Minds Wellbeing Index measured.

- Implementation of wellbeing initiatives that promote physical and mental wellbeing.

- Ongoing maintenance of facilities and equipment.

There were no WHS prosecutions, notices or corrective actions during 2024-25.

Public complaints

Complaints received through the Australian Financial Complaints Authority

| Collections | 0 |

Policy | 2 |

| Service | 3 |

Collections Policy Service Complaints lodged with State Ombudsman | 0 |

Complaints direct to HomeStart

| Collections | 4 |

| Policy | 14 |

Service | 45 |

| Communication/Privacy | 4 |

| Other | 0 |

Total complaints | 72 |

HomeStart is committed to conducting its business in accordance with the law as well as best practice and Australian Standards. Consistent with this commitment, HomeStart’s Complaints Management Policy is guided by AS/NZS ISO 10002-2022 Guidelines for complaints management in organisations and ASIC’s Regulatory Guide 271 – Internal Dispute Resolution.

A customer complaint register provides valuable information and feedback to ensure policies and procedures remain current.

Consultancy expense

Consultant | Purpose of consultancy | Number | Cost $’000 |

Total consultancies below $10,000 | Process optimisation | 1 | 1 |

Total consultancies $10,000 and above | |||

| Brett & Watson Pty Ltd | Actuarial Reviews | 1 | 26 |

| Deloitte Touche Tohmatsu | Treasury Management System | 1 | 77 |

Total consultancies | 3 | 104 |

Financials

HomeStart achieved an underlying profit before tax of $48.1M in 2024-25, up from $39.5M in the previous year, reflecting strong portfolio growth and a higher net interest margin. The buoyant property market underpinned significant realised and unrealised gains on HomeStart’s shared equity portfolio.

Once unrealised gains and loan provisioning changes were included, HomeStart achieved a headline profit before tax of $65.1M ($49.3M, 2023-24).

HomeStart continued to provide substantial payments to the Government, amounting to $100.6M for the year, and $1.1BN since inception in 1989. HomeStart ended the year in a strong financial position, with excellent underlying profitability, sound credit and a pipeline of growth. Combined with the organisational focus of delivering social obligations to our customers within a commercial framework and prudent risk management, HomeStart continues to ensure long-term value for all. HomeStart received a Community Service Obligation (CSO) reimbursement of $9.1M in 2024-25 ($8.8M, 2023-24) recognising the cost of providing our non-commercial activities. HomeStart’s debt funding from the South Australian Government Financing Authority (SAFA) was $3.3BN against a borrowing limit of $3.7BN, with the Treasurer approving an increase to the limit during the year (2023-24 limit of $3.4BN).

Gross loan portfolio size

The gross loan portfolio increased during 2024-25 to $3.6BN ($3.1BN, 2023-24)

Asset and liability management

The gross loan portfolio increased during 2024-25 to $3.6BN ($3.1BN, 2023-24). While interest rates have fallen from their peak, market conditions remained challenging with elevated interest rates, rising house prices and cost of living pressures. This drove increased demand for HomeStart’s unique product offering. HomeStart delivered $1.4BN of new lending during the year ($1.2BN, 2023-24), which was a record level. The value of loans refinanced to other lenders has increased significantly this year to record levels, as customers benefit from the equity generated from strong property price growth and reductions in interest rates.

Funding

HomeStart’s lending is financed by its capital base and borrowings from SAFA. A global approach to treasury risk management continues to be applied, whereby risks are amalgamated from all activities and managed on a consolidated basis, taking advantage of offsetting risks. HomeStart’s Asset and Liability Committee (ALCO) reviews HomeStart’s Treasury policies and compliance with them.

Provisioning

HomeStart has recognised specific and collective provisions of $33.4M ($26.8M, 2023-24) against its loan portfolio, which is an increase on the prior year in line with growth in the loan portfolio.

Credit performance across the portfolio continued to be very strong. HomeStart’s customers are protected against increases in interest rates by the Repayment Safeguard, which means that loan repayments increase at or around the rate of inflation, rather than increasing in line with interest rates. This aspect of HomeStart’s loan products has helped to keep credit performance at a strong level.

Consistent with industry practice and the forward-looking nature of Australian Accounting Standards Board (AASB) 9 Financial Instruments, HomeStart retained a conservative posture in relation to provisioning for future bad and doubtful debts. This position reflects the general uncertainty surrounding the outlook for economic conditions in the coming year, with cost-of-living pressures expected to continue to present challenges for borrowers.

Management believes the sum of its specific and collective provisions constitutes adequate provisioning to meet potential loan losses in the future.

Financial indicators | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

Headline profit ($M) | 15.6 | 17.0 | 20.3 | 18.9 | 23.3 | 31.2 | 49.6 | 55.7 | 37.7 | 49.3 | 65.1 |

Net interest margin (%) | 1.0 | 1.1 | 1.3 | 1.2 | 1.3 | 1.9 | 2.2 | 2.2 | 1.8 | 2.3 | 2.5 |

Balance sheet strength | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| Capital ($M) | 173.2 | 157.3 | 165.4 | 162.2 | 159.2 | 158.4 | 161.6 | 185.4 | 181.6 | 169.0 | 160.0 |

| Provisions ($M) | 18.0 | 17.3 | 18.2 | 17.5 | 18.6 | 23.4 | 20.6 | 19.7 | 20.6 | 26.8 | 33.4 |

| Gross loan portfolio ($M)1 | 1,840.2 | 1,867.7 | 1,939.7 | 2,103.1 | 2,245.7 | 2,227.5 | 2,280.5 | 2,119.4 | 2,415.1 | 3,131.0 | 3,563.7 |

1 Gross loan portfolio excludes Wyatt, Starter and SEO Construction products which are administered by HomeStart on behalf of the Wyatt Trust and South Australian Housing Authority (SAHA).

Financial contributions to the State Government

$1.1BN paid to the State Government since inception

Payment type ($M) | 1995-20151 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | Total |

Guarantee fee | 241.2 | 26.5 | 28.0 | 28.6 | 29.7 | 27.5 | 22.9 | 19.7 | 18.0 | 23.3 | 31.6 | 497.0 |

SAFA2 admin fee | 14.2 | 1.0 | 1.0 | 1.1 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.5 | 1.7 | 26.5 |

Tax equivalent | 67.3 | 4.9 | 5.2 | 6.2 | 6.0 | 9.0 | 11.0 | 16.0 | 16.8 | 12.9 | 19.1 | 174.4 |

Dividends | 86.9 | 7.1 | 7.1 | 9.1 | 14.8 | 22.3 | 26.2 | 46.4 | 26.1 | 32.9 | 48.2 | 327.1 |

Interim (special) dividend | 47.3 | 20.0 | 0.0 | 10.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 77.3 |

Total paid | 456.9 | 59.5 | 41.3 | 55.0 | 51.7 | 60.0 | 61.3 | 83.4 | 62.1 | 70.6 | 100.6 | 1,102.4 |

1 no payments made prior to 1995 | 2 South Australian Government Financing Authority

Contributions reflect cash payments made to the State Government during the year, and exclude any CSOs received from the State Government.

Certification of financial statements

For the year ended 30 June 2025

We certify that the:

- financial statements of HomeStart:

- are in accordance with the accounts and records of HomeStart Finance

- comply with relevant Treasurer’s Instructions; and

- comply with relevant accounting standards; and

- present a true and fair view of the financial position of HomeStart Finance at the end of the financial year and the result of its operations and cash flows for the financial year.

- internal controls employed by HomeStart Finance for the financial year over its financial reporting and its preparation of financial statements have been effective.

Signed in accordance with a resolution of the Board members.

|  | |

Jim Kouts 16 September 2025 | Andrew Mills 16 September 2025 | Simon Olifent 16 September 2025 |