- Building a Home

- Finding a Home

- First Home Buyer

Why one-third of new borrowers are choosing the Shared Equity Option

If you’re considering buying your own home, chances are you’ve heard about shared equity. Whether you’re starting out or starting over, it’s an increasingly popular choice, with about one-third of new borrowers at HomeStart now choosing our Shared Equity Option.

.jpg)

What is Shared Equity and how does it help?

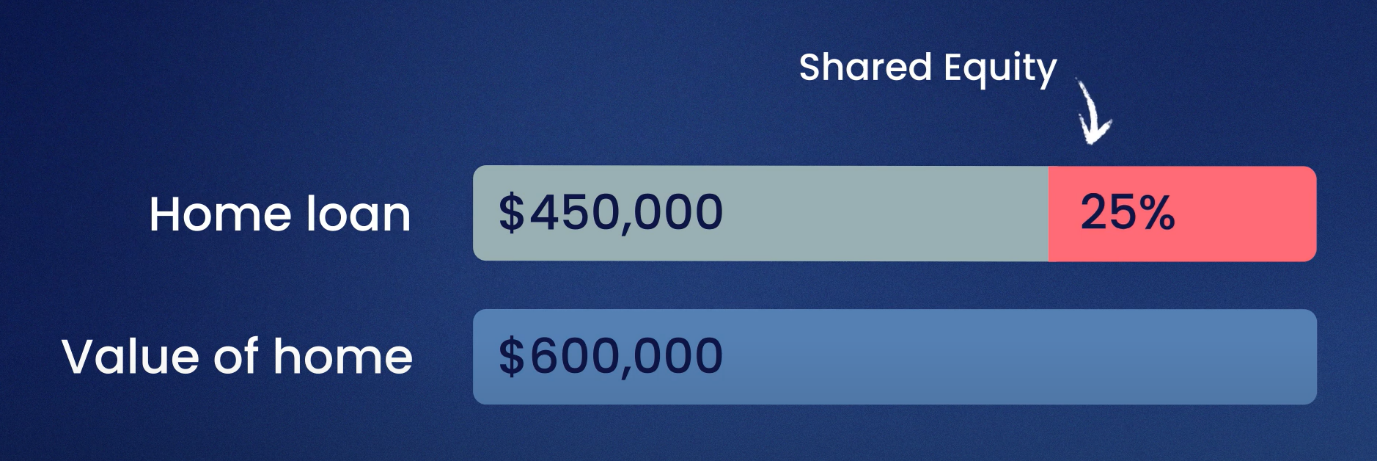

At HomeStart, a Shared Equity Option is an additional loan taken out at the same time as your home loan that makes buying a home more achievable. With this additional loan, HomeStart can lend you between 5% and 25% of the property value or purchase price, whichever is lower. You become the owner of the home, but you share some of its value with HomeStart.

Here’s an example of what Shared Equity could look like with 25% shared equity:

.png)

This scenario is provided for illustrative purposes only and excludes fees, charges, and any deposit required.

How does it work?

This two-minute guide walks you through shared equity step-by-step and helps you decide if the Shared Equity Option is the right choice for your home ownership journey.

Step 1 – Borrowing to buy your own home.

When you apply for a home loan with HomeStart, you have the option to apply for an additional loan we call the Shared Equity Option. It is available if your maximum net household income is up to $100,000 and the purchase price is no more than $675,000. The Shared Equity Option must also be less than your home loan amount.

Step 2 – Owning your home but sharing the value.

As a Shared Equity Option customer, you still own the home, but you share some of the value of the home with HomeStart. For example, if we lend you 20% of the purchase price, our share in the value of your property will be 20%. We won’t charge you interest on the shared equity part of your loan. Instead, when you sell your property, we will share in some of the gain or loss in property value.

Step 3 – Repaying your home loan.

You will make set monthly repayments on your home loan but do not need to make repayments or pay interest on the Shared Equity Option. You can choose to make voluntary repayments of $10,000 or more at any time to reduce HomeStart’s share in the value of your property. If you want to make a voluntary repayment, a property valuation of your home is done completed beforehand, to work out HomeStart’s new share of the value.

Step 4 – Selling your home.

You will only repay the Shared Equity Option when you sell your property, refinance with another lender, or make voluntary repayments. If you sell your home, you’ll pay off your entire balance of your home loan and the Shared Equity Option with HomeStart, sharing in any property value gain or loss. However, if you decide to refinance with another lender, partially discharge, or repay in full, HomeStart will only share in any gain in property value, not in any loss.

Here are three reasons to consider the Shared Equity Option:

1. Boost your borrowing potential by up to 25% of the property price.2. More choices in properties than you might otherwise have been able to afford.

3. Lower repayments as the Shared Equity Option is interest and repayment-free.