We’re not a bank. We think differently to be able to get more people into their own home sooner, so the way we work can also be unique.

Helpful Tips have been developed to assist brokers with clarifying what HomeStart expect to see on a HomeStart loan application and lodgement, which may not be the same as other lenders.

Check back regularly for updates. Helpful Tips are designed to help reduce the time it takes from loan application to approval.

-

Living Expenses

As part of responsible lending and verification, HomeStart requires a review of applicants’ transactional statements for the preceding three months. This is to confirm and verify the stated expenses, as well as to identify any which may not have been disclosed on the application.

Expense category inclusions for a HomeStart loan application:1. Food and Groceries Food, groceries, dining out and takeaway meals. This includes delivery services such as Uber Eats and Deliveroo. 2. Transport Vehicle registration, insurance, running costs, fuel and public transport. 3. Clothing Average family clothing costs. 4. Rates Estimated or known Council rates and/or strata fees. 5. Insurance Building insurance (HomeStart does not include contents, health, life or other insurance costs, vehicle insurance is captured in transport).

For the security property and any other properties held (including holiday homes).6. Utilities Post settlement known or estimated electricity, gas and water rates.

For the security property and any other properties held (holiday homes or vacant blocks).Rent Actual rental paid, irrespective of whether it is ongoing. This is required to support the applicant’s ability to service the proposed loan instalment commitment. -

HomeBuilder Grant – HomeStart Finance Application process

The HBG has created a significant amount of enquiry across lenders in the market, however, the barriers to home ownership through mainstream lenders still remain, as many will not factor the HBG for upfront costs when required to purchase land (for a new home build). However, HomeStart has taken the approach of leveraging the HBG by accepting it as a contribution towards the deposit and upfront costs associated with the house and land package.

HomeStart will allow for applicants conditionally approved for the HBG to settle on the land contract for the land cost, plus purchase and finance costs (less the amount of savings contribution from the borrower as evidenced on the broker quote).

Unlike the FHOG payments system, HomeStart is unable to act as an agent for the borrower and therefore, has no control over the lodgement, approval and payment of the HBG. Therefore, HomeStart require the borrower to lodge the HBG application and present evidence of:- Submission of HBG application (Revenue SA receipt acknowledgement)

- Conditional Approval and,

- Subsequently, the Full Approval of the HBG application.

1. HomeStart will accept the HBG (or part thereof) as a future contribution and should be included in the borrower quote in ''funds to contribute'', with a note detailing the amount of HBG to be used;

2. Initially, the broker should assess the key qualifying criteria for HBG including:

a. Income,

b. Australian Citizenship,

c. Residential Occupancy, and

d. Relationship of the Borrowers

3. The broker should also obtain the necessary evidence in support of the HBG application, which includes FY18/19 or FY 19/20 Notice(s) of Assessment and Proof of Australian Citizenship for all borrowers.

4. The broker should also obtain evidence that the borrower has secured a Hold or made a Deposit on land or has entered into a preliminary build contract.

5. Borrowers with an Advantage or Starter Loan who are using the HBG funds, are still subject to the maximum retained funds of $10k, which will include the surplus HBG funds.

6. If an extension of the build commencement is required, all parties to the build contract should be mindful that an extension application to RevenueSA is required and provide proof of acceptance to HomeStart.

7. Given the critical need to ensure that commencement of the build falls within 6 months of the date of the build contract, the loan application process should run in parallel to the collation and submission of the build pack, so that the build pack is ready to be submitted soon after HomeStart has given Pre-Approval on the loan application.

8. Where required, HomeStart will advance up to 100% of land value, plus land purchase and finance costs (less the amount of savings contribution from the borrower as evidenced on the broker quote) – this can occur upon receipt of evidence that the HBG application has been Conditionally Approved by RevenueSA.

9. The borrower must contribute all or part of their HBG towards the second progress claim. HomeStart will fund the balance of the second progress claim only upon evidence that the borrower has paid their contribution to the builder. The builder needs to evidence this by providing an updated statement of account reflecting payment of the borrower's contribution.

10. Section 2.3 Construction Loan in the Product Information Guideline has been updated to reflect the above temporary change for the HomeBuilder Grant.

Additional supporting documents required:

Submit for loan application Pre-Approval

1. Borrower Declaration (new form); (upload to Tracker > dedicated checklist item for HBG contribution)

2. Notices of Assessment; (upload to Tracker > Proof of employment)

3. Proof of Australian Citizenship; (upload to Tracker > Proof of Australian Resident)

4. Proof of Deposit for Land (upload to Tracker > Deposit Paid) or Preliminary/Conditional Build Contract or Hold on land (upload to Tracker > All Relevant Application Documentation); Submit for loan application Full Approval

5. Revenue SA receipt acknowledgement as proof of submission prior to approval from HomeStart; (via email to broker@homestart.com.au) Submit prior to Land settlement

6. Copy of the Conditional Approval by Revenue SA; (via email to newloans@homestart.com.au) At second progress claim (via email to progresspayments@homestart.com.au)

7. Updated Statement of Account from the builder evidencing that the borrower has paid their contribution towards the second progress claim;

8. The second progress invoice (where required)

9. Evidence that a further 3-month extension is approved (where required); (via email to broker@homestart.com.au)

If you have any questions about how HomeStart is utilising the HomeBuilder Grant please contact your Business Development Specialist. -

Tips from our assessors - June 2020

HomeStart understands the loan application process is not always seamless. This newly created segment will provide some helpful information to tackle roadblocks and streamline the process. Here are our latest tips to help you with your client’s loan application.

As a lender with unique offerings, HomeStart receives questions from brokers about a variety of scenarios for clients that most financial institutions may not be able to support.

Scenario 1:

Our Business Development Specialists often receive questions about newly migrated couples where only one of them is a permanent resident or Australian citizen, while the other is yet to receive their permanent residency status. In this case, HomeStart will still accept an application with both parties listed, however, the non-resident’s income cannot be calculated in servicing the debt and they must be on a temporary spousal visa. Alternatively, the non-resident can be excluded from the application and instead be listed as a dependent of the applicant. In this case, the applicant is required to have separate banking to demonstrate they can satisfy all the required eligibility criteria on their own.

PLEASE NOTE

Under some circumstances in which a loan is approved for a couple, where one is an Australian citizen/permanent resident and the other party is a non-resident (this would have to be approved under delegated lending authority), there may be additional stamp duty payable.

It is recommended that if this occurs, your client be referred to their conveyancer to determine the exact amount of stamp duty that is required, as it will impact on their contribution to the settlement amount - Revenue SA Stamp Duty On Conveyances Calculator. HomeStart Finance has experienced a settlement where there was an additional $8,000 required from the client because of this issue.

Scenario 2:

As the year unfolds, we anticipate an increase in demand for refinance loans with HomeStart. As a result of the current environment, many South Australians could find themselves in a new job or role, potentially with less income or under different conditions than what they were working prior to COVID-19.

If you have a client that is facing this situation, where they are unable to continue servicing their existing loan with another lender due to these changes, HomeStart may be able to assist. As a timely reminder, we can refinance up to 90% LVR with the HomeStart Home Loan, which is available with a fixed, variable or split interest rate. In divorce situations, where more than 90% LVR may be required, please speak to your Business Development Specialist.

For those who are eligible and require further assistance in boosting their borrowing power, our Advantage Loan can be included. There is also an option for clients to refinance from a reverse mortgage loan with another lender to our Seniors Equity Loan. HomeStart’s Shared Equity Option can also help people who need a little extra to buy the home they want, however, this loan can only be written internally by HomeStart. Eligible brokers can ‘spot and refer’, contact your Business Development Specialist to see if you are eligible, or if you have a customer that could be referred.

HomeStart can also assist with including a level of consolidation with unsecured debts, such as credit cards and/or personal loans, up to $20,000. Reducing the interest paid on some of these debts would no doubt be important to these clients during these uncertain times.

If there are any questions or concerns regarding customer scenarios, our Business Development Specialists are available by phone or email to answer these. -

Tips from our assessors - March 2020

HomeStart understands the loan application process is not always seamless. This newly created segment will provide some helpful information to tackle roadblocks and streamline the process. Here are our latest tips to help you with your customer loan application.

1. Understand the importance of submission notes

Our new Application Submission Notes template provides you with a guide for the extra information HomeStart require about your customers at a minimum and are often the cause of application processing delays. The Application Submission Notes allow for you to elaborate on information that cannot be provided elsewhere, such as via Apply Online, for example, comments around living expenses. You don’t need to repeat the information you have already provided, such as whether your customer is married or the number of children they have, rather include comments on how their expenses were determined and other details that will be important to us in assessing their application. The more additional information we have, the faster the application can progress through the process.

2. Know how to calculate income

Income looks different for everyone, which is why it is important to understand how to calculate the varying types such as overtime or shift allowances, casual payments and Centrelink contributions. Here are some quick tips when assessing your customers’ pay packets:- If overtime or shift allowances are being included as income, an Employers Certificate of Income form is mandatory if the income has consistently been received for the preceding six months.

- Casual income must be calculated over a 48-week period, and an Employers Certificate of Income form needs to be provided. You also need to upload a copy of the HomeStart Year to Date calculator that has been used to determine the casual income (refer to the calculator on the Homestart Broker website, which has the 48-week rule included).

- Check your customers’ employment contract to ensure they are not on probation prior to submitting the application. We can’t use the income of applicants on probation.

- Assess the customers’ payslips to see if they salary sacrifice. If so, we recommend you load this as a separate income source called ‘Salary Sacrifice’ on the HomeStart Home Loan Quote. The calculator does all the calculations for you - and don’t forget to provide the necessary documentation.

- In terms of Centrelink Income (Family Tax benefit A), HomeStart will only accept this for children up to and including 15 years of age at the date of the application,

- In terms of Family Tax benefit B, we will only accept this if the youngest child is 10 years of age or younger at the date of the application.

- Centrelink Income, with the exception of Family Tax Benefit A & B, are to be loaded as ‘Pension Income’ when submitting the application in Apply Online/HomeStart Home Loan Quote.

- The Energy Supplement from the Centrelink income statement can now be included as income on HomeStart applications.

3. Be aware of other credit facilities and debts

You must be mindful that your customers may have other credit facilities or debts outside of the usual credit cards and personal loans. Look for Australian Tax Office liabilities, often more prevalent in customers who are self-employed, and ongoing credit platforms such as Zippay, Zipmoney, After Pay and so on. You should also ensure you look over statements to ensure these facilities are well conducted. Mitigate any one-off blemishes and address in your notes with why these occurred.

You should also check if the customer has any outstanding HECS/HELP debt that would have funded their higher education studies. These should be treated as a liability if you have assessed their income to be above the threshold.

4. Verify all living expenses

There are a variety of living expenses that need to be taken into consideration when lodging an application – anything from rent, groceries and utility bills to using PayPal for Uber Eats. Your customers’ living expenses must be verified against all bank statements, credit card statements and salary sacrifice wallets – anywhere they spend money relevant to our six categories.

If the applicant can meet our Net Surplus Income (NSI) requirements (Lending Policy 12.1), then living expenses do not necessarily have a direct impact on borrowing capacity.

It is also worth noting that one of our six living expense categories is Building Insurance (listed as ‘Insurance’ in Apply Online). You are only required to input the Building Insurance monthly premium in this field. You won’t need to input other types of insurance, such as private health and income protection. -

Capacity to repay

It is a HomeStart requirement for applicants to demonstrate a capacity to service the proposed HomeStart loan over a 3 month period. As a result, reasonable steps must be taken to determine whether a proposed loan is ‘not unsuitable’, that it is unlikely to cause applicants substantial financial hardship, and to determine the applicants’ ability to comply with the terms and conditions of the loan contract.

Rent and/or savings needs to be equal to or greater than the HomeStart monthly loan per month over the preceding 3 months.

An example of an acceptable demonstration:- Applicants are applying for a loan with a $2,000 monthly repayment. They currently pay $1,500 monthly as rent, and have a demonstrated saving history of $500 per month for the preceding 3 months.

Savings accounts that reduce over the preceding 3 month period would generally not be deemed as an acceptable demonstration. However, we will consider shortfalls, where identified lifestyle changes in savings and expenses could aid the capacity to repay (e.g. decision to cancel discretionary spend such as Neflix or Spotify). These lifestyle change decisions must be declared by the applicant and the expenditure(s) identified in recent bank statements. This must be supported with commentary in your submission notes.

-

Demonstrating Net Surplus Income (NSI)

It is a HomeStart requirement for applicants to demonstrate a net surplus income position, after the proposed monthly loan instalment. It is important that living expenses and liabilities are considered.

Undertake the following steps to calculate NSI:- Determine the Net monthly income

- Subtract the ongoing living expenses (as verified to transactional statements)

- Subtract the HomeStart monthly loan repayment and other monthly liabilities

HomeStart expects applicants to be able to demonstrate a Net Surplus Income (NSI) of at least 5% of their assessed net monthly income.

If submitting an application where NSI is less than 5% surplus per month, HomeStart require the Loan Consultant to provide extensive commentary in the notes, supporting the reason for the loan application to proceed. -

Living Expenses

As part of responsible lending and verification, HomeStart requires a review of applicants’ transactional statements for the preceding three months. This is to confirm and verify the stated expenses, as well as to identify any which may not have been disclosed on the application.

Expense category inclusions for a HomeStart loan application:1. Food and Groceries Food, groceries, dining out and takeaway meals. This includes delivery services such as Uber Eats and Deliveroo. 2. Transport Vehicle registration, insurance, running costs, fuel and public transport. 3. Clothing Average family clothing costs. 4. Rates Estimated or known Council rates and/or strata fees. 5. Insurance Building insurance (HomeStart does not include contents, health, life or other insurance costs, vehicle insurance is captured in transport).

For the security property and any other properties held (including holiday homes).6. Utilities Post settlement known or estimated electricity, gas and water rates.

For the security property and any other properties held (holiday homes or vacant blocks).Rent Actual rental paid, irrespective of whether it is ongoing. This is required to support the applicant’s ability to service the proposed loan instalment commitment. -

What HomeStart considers a debt or liability that you may not be aware of

As part of responsible lending and verification, HomeStart requires a review of applicants’ transactional statements for the preceding three months. In addition to the review of expenses, this process is also to confirm and verify the stated debts or liabilities, as well as to identify any which may not have been disclosed on the application.

Debts or liabilities are usually ongoing fixed payments, which are different to discretionary expenses.

These include, but are not limited to:- HECS/HELP;

- Private school fees (do not include Public School fees);

- Childcare & OHSC fees;

- Child maintenance;

- ATO liability;

- Government issued fines, e.g. speeding fines;

- Centrelink Debts;

- Vetpay;

- Salary sacrificed vehicle lease/loan repayments;

- Radio Rentals obligations;

- Humm;

- Zip Pay obligations; and

- Zip Money obligations;

- Orthodontics;

- Skye;

- Payday loan

-

Instructions for writing a Starter Loan (Starter Loan accredited brokers)

1. Download/Print Application Lodgment Pack from HomeStart Broker website, under Forms & Brochures then Application Forms (Apply OnLine will be updated on 25 September 2019).

2. Ensure the customer has read the new Starter Loan statement on the second page of the Customer Fact Find.

In Apply OnLine:

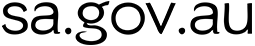

Starter Loan amount to be entered as “Other”, with the Description as ‘Starter Loan’ in the Loan Details Screen as below:

1. Add details in Application submission Notes

In Tracker:

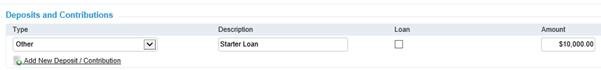

1. Upload the Application Lodgement Pack documentation under the checklist/field as below:

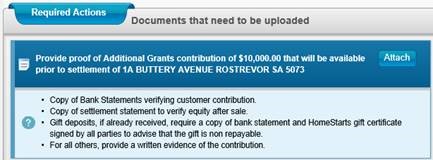

2. Upload the Application Lodgement Pack documentation again under the checklist/field ‘Provide all relevant application documentation as below:

Use of acceptable income

HomeStart Finance has a range of subsidised interest rate loan products and therefore it is essential that all acceptable income is included in the loan application to ensure that the borrowers’ true financial position is assessed. -

Tips from our assessors - December 2019

HomeStart understand the loan application process is not always seamless and unexpected roadblocks can crop up. We are launching a regular new segment called Tips from Our Assessors that will provide some helpful information to streamline the process. Here are our first lot of tips to help you with your customer loan application.

1. Apply for maximum construction pre-approval

Building a home is an exciting prospect, but it is not uncommon for the overall price to increase throughout the process. The final fixed cost will not be known until your customers has chosen their build selections (fixtures and other items) – and depending which they choose, the final price can vary significantly from the original quote. Our assessors receive requests to increase the pre-approved loan amounts for construction loans for over 50% of all applications and in some cases, this can occur within only a matter of days after issuing a pre-approval letter to the customer. This can draw out the process and create unnecessary delays. In order to avoid this, our assessors recommend brokers apply for pre-approval based on the maximum amount the applicant can borrow considering their income, liabilities, available deposit funds and their ability to repay the mortgage. It is a lot easier to reduce the loan amount if the maximum applied for is not required.

2. Recommend a continued savings plan

When customers receive pre-approval for their loan, they often stop their savings plan, as they believe they have the necessary funds to obtain their loan and begin the homeownership process. We believe it is important to continue saving until they receive final approval to ensure they meet the ability to repay requirements. This is particularly important if they are unable to locate their ideal property and the pre-approval expires, requiring a brand-new application, which of course requires a detailed savings history. This is also the case if their situations change and we need to do another assessment.

3. Advise against additional credit

It’s easy to get caught up in the hype of buying a new property, wanting to shop around for furniture to create the dream home. But it is not wise to take out additional lines of credit as this could lead to a credit enquiry, therefore impacting our assessment during pre-approval. Advise your customers to hold off on their shopping sprees until their loans are finalised.

4. Reminder about Build Packs

Bonus tip from our Loan Processing Team regarding Build Packs: Please do not upload construction documents into Tracker. Instead submit these via email to buildpacks@homestart.com.au. This should only be done one pre-approval has been granted, after confirmation with the customer that they have completed their final selections/variations and have had their final interview with the builder. Please ensure your customer has met the minimum standards as appropriate to the application. -

Starter Loan Questions and Answers (Q&As)

What is the Starter Loan?

- The Starter Loan is an initiative of the 2019 South Australia State Budget, supported by the Affordable Housing Fund and administered by HomeStart.

- The aim of this loan is to enable more South Australians to get into home ownership, by providing assistance with upfront costs, such as Stamp Duty.

- The $2M funding will be available for 2 years, potentially generating 200 new housing outcomes in SA as part of a $60M program.

- The Starter Loan is a secondary loan taken out with a primary HomeStart loan to help cover the upfront costs for buying or building a home.

- The Starter Loan has a five-year term, with no repayments required or interest charged during those five years. At the end of the five years, if the Starter Loan is not paid in full, it will be reviewed and may be transferred to the primary loan balance. Depending on circumstances, all or part of the Starter Loan may be extended by HomeStart.

- Customers may apply for a Starter Loan if they meet the eligibility criteria.

- Eligible customers may borrow a minimum of $3,000 and up to $10,000, if they meet the following criteria:

- Qualify for a primary HomeStart loan

- Have a net household income of less than $65,000 for singles and $90,000 for couples

- Not own other property

- Have enough funds to cover the deposit, but not enough for the remaining upfront costs like Stamp Duty

- Customers must be buying an established home or constructing a new home

- Available for owner-occupiers only

- Limit personal savings (post settlement) to a maximum of $10,000 subject to HomeStart approval

- Customers can check the balance of all their loans through the HomeStart Online website.

- Customers must apply for the Starter Loan during the initial application process. The Starter Loan is available for two years from 1 September 2019 and subject to the availability of funding from the Affordable Housing Fund.

- There are no upfront fees of obtaining a Starter Loan.

- No repayments are required during the five-year Starter Loan term, although it is encouraged to make voluntary repayments.

- At the end of the five years, if the Starter Loan is not paid in full, it will be reviewed and may be transferred to the primary loan balance, which may increase the loan term. Once the Starter Loan is transferred to the primary loan, interest will be charged. Depending on circumstances, all or part of the Starter Loan may be extended by HomeStart. Page 2 of 2 1908 HomeStart Finance Australian credit licence 388466

- Repayments are only required on the primary HomeStart loan during the five-year Starter Loan term. After this, the Starter Loan will need to be paid in full or, in appropriate circumstances, HomeStart may combine the outstanding Starter Loan balance with the primary HomeStart loan balance, which may increase the loan term.

- Customers can elect to make voluntary repayments on top of the minimum repayment amount for their primary loan, at any time. These repayments must be directed to the Starter Loan, to reduce the Starter Loan balance.

- On the fifth-year anniversary of settlement the Starter Loan is due to be paid in full. If the Starter Loan is not paid in full, it will be reviewed and may be transferred to the primary loan balance, which may increase the loan term. Once the Starter Loan is transferred to the primary loan, interest will be charged. Depending on circumstances, all or part of the Starter Loan may be extended by HomeStart.

- At the end of the five years, if the Starter Loan is not paid in full, it will be reviewed and may be transferred to the primary loan balance, which may increase the loan term. Depending on circumstances, all or part of the Starter Loan may be extended by HomeStart.

Loan term sensitivity for changes to interest rates

Assumptions – interest rate is unchanged for life of the loan, CPI at 2.50% for life of the loan, no voluntary repayments have been made to the Starter Loan or Primary loan.Interest Rate % Loan term

(months, no

Starter Loan)Loan term

(Months, with

Starter Loan)Loan term

change

(months)3.94% 219 227 +8 4.94% 245 255 +10 5.94% 281 294 +13 -

Customer identification for Apply Online

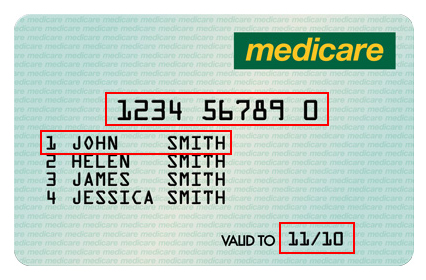

HomeStart accept the following two forms of identification for submission into ApplyOnline:

- Valid Driver’s Licence (HomeStart’s preferred identification) or;

- Medicare card

When adding Medicare card details into ApplyOnline, please include the highlighted details below:

Please note, it is a HomeStart Finance Lending Policy requirement that the identification procedure (CIP) is followed correctly to ensure reasonable steps to verify applicants’ identity have been demonstrated. Other documentation is accepted as proof of identity and a comprehensive verification process exists for the purpose of the CIP and entry into Tracker, the above forms of identification is for data entry into ApplyOnline only. -

Entering gifts towards the purchase in Apply Online

Applicants expecting to receive gifted funds for use towards the purchase which have not yet been received, and/or gifts received which have already been used as deposits (paid to the agent or builder) should be entered into ApplyOnline as a contribution towards the purchase, not listed as an asset.

The only exception to this rule is when applicants receive gifted funds which are held at the time of the application, e.g. when gifted funds have been deposited to the applicants’ bank account. In these circumstances gifted funds should be included both as an asset and as a contribution towards the purchase. -

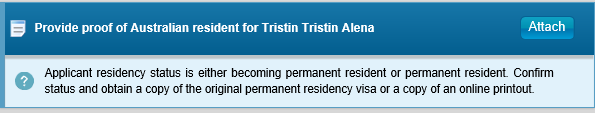

Residency status

Applicants who are born overseas should be added as a permanent resident, irrespective of whether they are an Australian citizen.

HomeStart’s Lending Policy requires applicants who are born outside of Australia to provide evidence of permanent residency or citizenship.

Selecting permanent resident as a residency status in ApplyOnline triggers a requirement field in Tracker, which enables the upload of the required evidence of their permanent residency or citizenship.

Residency details in Apply OnLine

Tracker

-

Variations to the contract when building - surface stormwater

When providing documentation relating to a build, it is important to look out for variations to the contract which may be the responsibility of the owner.

You may come across variations stating that the surface stormwater is the responsibility of the owner, which may be worded in the following way:- Disposal of roof stormwater only by builder. All surface stormwater is the responsibility of the owner.

In these cases, it is required that an independent quote for the surface stormwater is included with the Build Pack.

-

Witnessing HomeStart loan contracts

Our brokers are an integral contributor to our business of assisting more South Australians into the dream of home ownership - we know our customers value the service you provide, and we do too.

Your feedback and that of our customers is important to us and helps us take action where it counts. As a result, we have reviewed our previous position that witnesses to HomeStart loan contracts must be a disinterested party with no financial or other interest in the transaction.

Although it is not recommended by HomeStart, brokers may now witness the signing of HomeStart loan contracts.

In order to remove any risk of actual or perceived conflict of interest, it remains a requirement that customers hold HomeStart loan contracts for 24 hours before signing and returning the documents to HomeStart.